Arts Funding

OVERVIEW

Local governments, artists, and arts organizations rely on an array of funding sources to raise revenue for arts and culture programs, projects, and initiatives. In addition to the municipal, regional, and state public art policies that are described in the art and infrastructure section, the four primary sources for funding for arts and culture are:

01

Funds distributed by federal, state, county, and municipal arts agencies

02

Funds from federal agencies and departments

03

Contributions from the private sector, including individuals, foundations, and corporations

04

Fee-for-service programs, productions, events, and consulting services

PROCESS of FUNDING by PARTNER

U.S. Federal Funding, Programs, and Policies for Arts and Culture

The federal government has a history of connecting arts, culture, and public policy since the earlier part of the 20th century. A series of New Deal programs created by President Roosevelt and a series of Great Society programs created by President Johnson created government jobs for artists to creates works for public buildings and public spaces. These programs included the Section of Painting and Sculpture, which was created in 1934 and administered by the United State Department of the Treasury, the Federal Art Project (FAP), which was created in 1935 and administered by the Work Projects Administration (WPA); the Comprehensive Education and Training Act (CETA), which was created in 1973; the Guiding Principles for Federal Architecture (1962), which was issued in a report to President Kennedy on the subject of federal office space; and the National Endowment for the Arts and the National Endowment for the Humanities, which were created in 1965. The first three programs put artists to work on decorating public buildings; commissioning permanent works of public art in federal buildings and infrastructure construction projects; and provided seed funding for the establishment of public art nonprofits affiliated with local jurisdictions. All of these programs have generated hundreds of thousands of jobs for American artists.

Many other federal departments and agencies also employ the arts in advancing strategic missions to promote objectives pertaining to beautification of civic infrastructure, educational and cultural exchange, historical preservation, and economic development. These agencies include the United States Geological Survey, the Department of Defense, the Bureau of Educational and Cultural Affairs, the General Service Administration, the National Parks Service, and the U.S. Department of Housing and Urban Development's Sustainable Communities Program.

Jump-to

Learn More

Case Studies

The National Endowment for the Arts

The NEA serves as the designated arts organization of the federal government. The NEA, together with allied and independent state, regional, and jurisdictional arts agencies and councils, provides public funding for arts and culture. Congress established the NEA as the federal agency tasked with advancing artistic excellence, creativity, and innovation through grantmaking, fellowships, awards, research, and special initiatives that promote the development and preservation of artistic and cultural mediums. Since its founding, the NEA has awarded over $5 billion towards projects that aim to "strengthen the creative capacity of our communities."

The NEA's annual funding is variable and determined annually by Congress. The House and Senate Appropriations Committees are the two subcommittees that oversee the U.S. Department of the Interior, Environment, and Related Agencies -- including the NEA. Today, approximately 90 percent of the NEA's state partnership funding is allocated via formulas based on population and equal state proportions; the balance is awarded to states and regions competitively. The NEA is required by law to distribute 40 percent of its annual grants budget to the six Regional Arts Organizations (RAO) and state arts agencies (SAAs). The RAOs receive competitive funding from the NEA, which they re-grant through regional programs and fellowships. The SAAs fund a wide variety of work in the arenas of arts education, artistic heritage, cultural infrastructure, arts accessibility, and arts participation; this work is funded through a range of public funding mechanisms.

State Funding, Programs, and Policies for Arts and Culture

Funding for individual artists and arts organizations is primarily generated at the state level. As of FY2016, the majority of public funding for the arts is generated from state, county, and municipal appropriations and expenditures. Within this mix, the largest source of funding for state arts agencies (SAAs) is state general funds. Other mechanisms utilized by states included taxes and fees. Funds generated through these mechanisms are often used to fund the activities of SAAs and other government-affiliated arts organizations, such as Arts and Tourism Commissions. Pressures on state budgets have increased state reliance on taxes and fees. Some of the creative ways in which states have used fees to secure funds for arts services provided to individuals or entities and used taxes to generate revenue for arts and culture services of benefit to the general public include:

- Designation of a portion of hotel/motel fees;

- Designation of a percentage of room taxes, tourism taxes, sales taxes, and/or conservation taxes;

- Designation of a percentage of corporate filing fees and recordation fees from documents filed with county recorders;

- Allocation of a portion of funds from gaming revenues;

- Allocation of a portion of proceeds from the sale of special license plates;

- Income tax check-offs permitting residents to earmark dollars to SAAs; and

- Bond issues associated with capital improvement programs for cultural facilities for a limited duration of time.

Regional and State Sources of Funding in Massachusetts

Federal and state dollars appropriated from the federal government and from the Commonwealth are disseminated to cities, towns, and individual artists through two agencies: The Massachusetts Cultural Council -- the SAA in Massachusetts -- and the New England Foundation for the Arts -- the RAO serving Massachusetts.

The New England Foundation for the Arts (NEFA) was founded in 1976 and its grants and programs strive to support artists, fuel creative exchange and public discourse, and strengthen the creative economy. According to NEFA's 2015 annual report, 74.2 percent of its revenue was raised from foundations, corporations, and federal sources not including the NEA; 16.1 percent was an appropriation from the NEA; 1.6 percent was from State Arts Agencies; and 8.1 percent was from individual donors, earned income, and interest and dividend income. NEFA's programs and initiatives include creative economy research and data collection, and grant awards to individual artists in the visual, music, and performing arts. (2015)

The Massachusetts Cultural Council (MCC) is the Commonwealth's state arts agency. Its mission is to promote excellence, access, education, and diversity in the arts, humanities, and interpretive sciences in order to improve the quality of life for all Massachusetts residents and to contribute to the economic vitality of our communities. The MCC awards fellowships to individual artists and administers grants through a dozen different programs that are funded through an annual appropriation from the state Legislature, funds from the National Endowment for the Arts, and other sources.

Visit the links provided below to learn more about MCC's programs on their website. Read more about Local Cultural Councils here, Cultural Districts here, and Cultural Facilities here.

- Artist Fellowships: Fellowships to artists in recognition of exceptional work.

- Big Yellow School Bus: Grants to help schools meet the costs of providing educational field trips to cultural institutions and events across the Commonwealth.

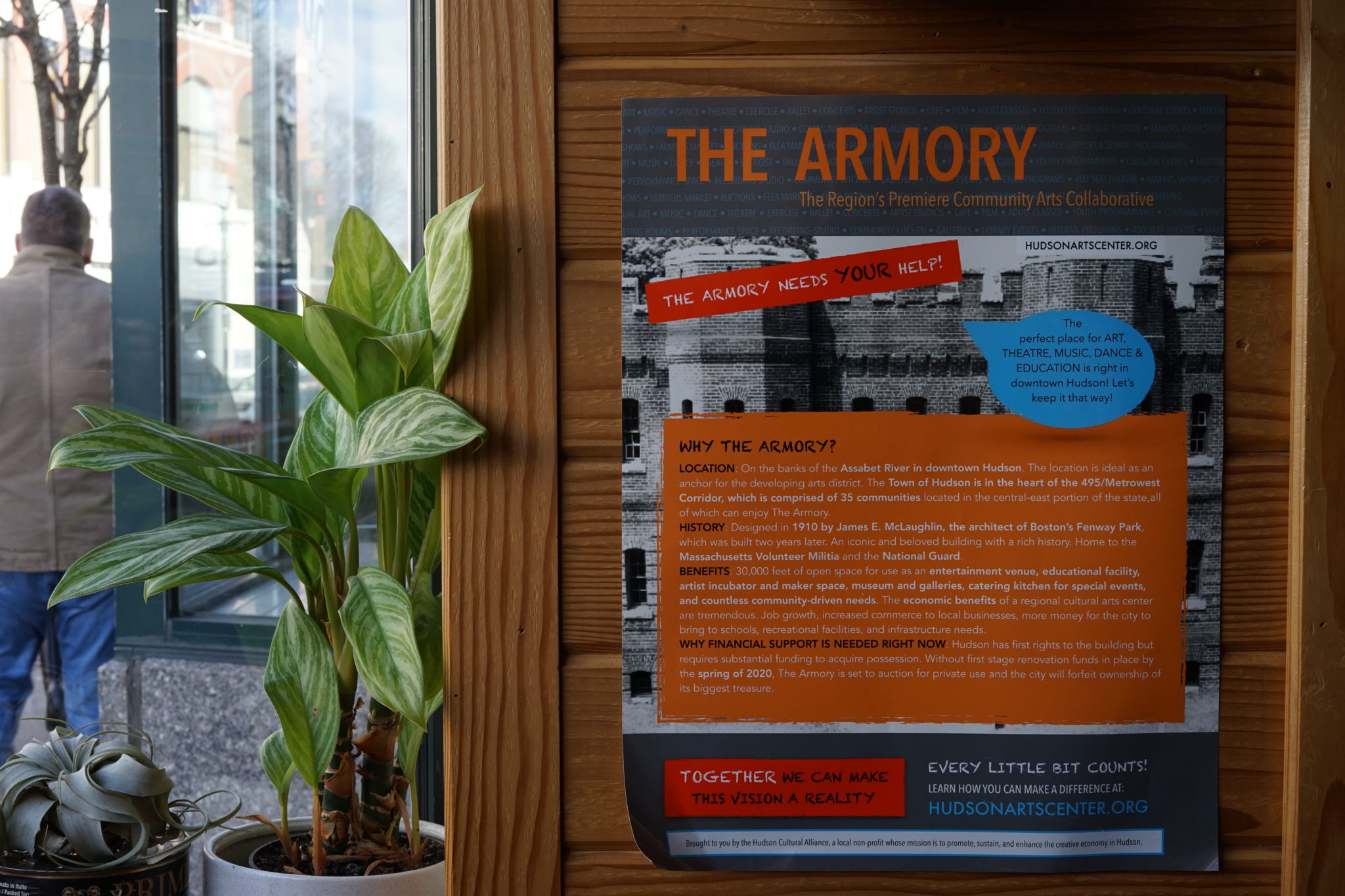

- Cultural Facilities Fund: An initiative of the Commonwealth of Massachusetts, the goal of the Fund is to increase investments from both the public sector and the private sector to support the sound planning and development of cultural facilities in Massachusetts.

- Cultural Investment Portfolio: A fresh approach to unrestricted funding for nonprofit arts, humanities, and interpretive science organizations that aims to better position the cultural sector as vital components of Massachusetts' economy and the quality of life of our citizens.

- Festivals Program: A pilot program designed to provide funding to help festival programmers meet the needs of producing, promoting, and developing audiences.

- Local Cultural Council Program: Local Cultural Councils serving every city and town in Massachusetts offer grants to projects benefiting their community.

- New England States Touring Program (NEST): A cooperative program between the New England Foundation for the Arts (NEFA) and the state arts agencies of New England that provides support to nonprofits for performances, readings, and related community activities by artists.

- SerHacer: A new initiative focused on supporting the growing number of intensive, ensemble-based music programs that use music as a vehicle for social change.

- STARS Residencies: Grants to schools for residencies of 3 days or more with teaching artists, scientists, scholars, or cultural organizations.

- Traditional Arts Apprenticeships: A part of the Massachusetts Folk Arts and Heritage Program, apprenticeships support the teaching of traditional arts that are specific to a particular folk group or ethnic community.

- YouthReach: Multi-year grants to programs that integrate substantive out-of-school arts, humanities and science opportunities into a collaborative community response to the needs of youth at risk.

Charitable Foundations

Below is a list of major philanthropic sources of funding for arts and culture.

Tax credits and Tax incentives for Arts and Cultural districts

Arts and cultural districts can be defined in zoning in the absence of state legislation and programs guiding their certification or designation. Incentives can also be offered to promote adaptive reuse of structures for cultural facilities within designated districts.

State, regional, and local cultural district programs are supported through a variety of tax incentives that may be implemented at the city, town, county, or state levels. This includes exemptions and credits offered to creative sole proprietors and creative industries operating within a district. Examples of the types of incentives offered to established cultural districts include:

- Sales tax credits or exemptions for goods produced or sold within the district.

- Property tax credits or exemptions for qualified renovations or construction.

- Income tax credits or exemptions for artists living and working within the district.

- Preservation tax credits for historic property renovations and rehabilitation.

- Amusement/Admission tax waivers for events within the District.

- Eligibility for special loan funds.

The city of Providence, Rhode Island has pioneered innovative tax incentives for arts districts. City staffers, artists, and private developers have also worked together to reclaim underutilized space for artist spaces. Artists living in the ten designated arts districts have the sales tax waived on purchases of their original artwork and pay no state income tax on income from their art. The City?s planning department also provides below-market loans and technical assistance for the acquisition of spaces for artist studios and live/work space.

Learn More

A guide produced by MassDevelopment in 2016 provides links to a variety of public and private sources of funding for creative placemaking and public art.

References

- Atlas, Caron. 2002. "Cultural Policy: In the Board Rooms and on the Streets." Accessed on September 5, 2015, http://wayback.archive-it.org/2077/20100906195303/http://www.communityarts.net/readingroom/archivefiles/2002/08/cultural_policy.php.

- Calderwood-Ginn, Jon and Bob Leonard. 2012. Playing for the Public Good: The Arts in Planning and Government. Washington, D.C.: Americans for the Arts. http://animatingdemocracy.org/sites/default/files/LCrane%20Trend%20Paper.pdf.

- Miller, Stephen R. 2012. "Percent-for-Art Programs at Public Art's Frontier." Zoning and Planning Law Report 35 (5): February 24, 2016. http://papers.ssrn.com.ezproxy.library.tufts.edu/sol3/Delivery.cfm/SSRN_ID2110341_code1475204.pdf?abstractid=2110341&mirid=1.

- General Services Administration. 2015. Guiding Principles for Federal Architecture. Washington, D.C. http://www.gsa.gov/portal/content/136543.

- National Endowment for the Arts. 2012. How the United States Funds the Arts, Third Edition. Washington, D.C. https://www.arts.gov/publications/how-united-states-funds-arts.

- National Assembly of State Arts Agencies. http://www.nasaa-arts.org

- Project For Public Spaces: Funding Sources for Public Art. https://www.pps.org/article/artfunding